Adjust payroll liabilities in QuickBooks Desktop Payroll

If the Installments-Payroll account has an amount remaining at year-end, confirm with your tax agency if the remaining amount will be carry-forward to the next year. If the Installments-Payroll account has a balance owing (a negative amount), you may need to remit the balance to the tax agency. Hawkins Ash CPAs uses an external secure online pay platform for accepting payments.

Step 1: Identify the Need for Adjustment

In the world of accounting and bookkeeping, managing payroll liabilities is a crucial aspect to ensure accurate financial records. QuickBooks, a widely-used accounting software, offers various tools and features to help businesses adjust, reconcile, and enter payroll liabilities seamlessly. Last month, I paid state and federal payroll taxes online, as I have done previously. What can I do so that each journal entry for these payroll taxes that I paid last month is properly identified as payment of payroll taxes? Zeroing out liabilities in QuickBooks involves ensuring that all recorded obligations and debts are accurately accounted for and balanced, eliminating any discrepancies and aligning the financial records with the current state of the company’s liabilities. For instance, if an employee’s vacation pay is adjusted retroactively, it would prompt a change in the accrued vacation liability.

- After making these individual adjustments, it’s essential to reconcile the payroll records with the amounts owed to avoid any discrepancies.

- This meticulous process helps maintain accurate and compliant payroll records for the organization.

- Zeroing out liabilities in QuickBooks involves ensuring that all recorded obligations and debts are accurately accounted for and balanced, eliminating any discrepancies and aligning the financial records with the current state of the company’s liabilities.

- Now that we’ve corrected your payroll records, I suggest you get in touch with the state agency.

- For those items that are not updated automatically (such as state unemployment tax rates), adding or modifying them is very simple.

Your projects are processes,

This recalibration process involves meticulously reviewing each payroll tax and liability entry, correcting any discrepancies or errors, and ensuring that the withholding amounts and employer contributions are accurately reflected. Once identified, incorrect amounts are zeroed out through careful adjustments, which involve reconciling the adjusted figures with the company’s financial records. This process necessitates a thorough review of the current payroll settings to identify areas that require modification. For example, if there are changes in tax laws, the tax categories must be adjusted accordingly to ensure compliance.

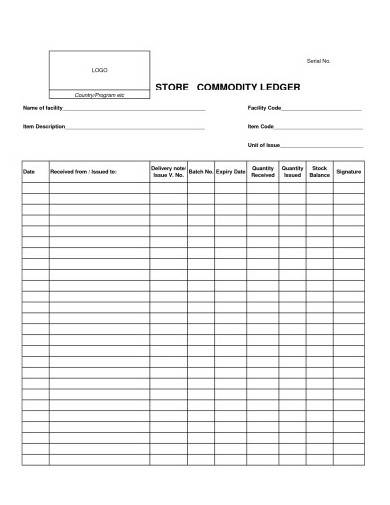

Hello Klent, Because our Payroll System was down when quarterly Payroll Tax was due, I paid the liability via telephone. If I follow the above instructions and change the liability amount in Payroll, how will I enter the payments made by phone?? If you need to track where your business stands in terms of employee expenses, you can customize the payroll and employee reports. If you have QuickBooks payroll for Desktop, tracking and paying payroll liabilities can be a quick way to be reminded when your payroll deposits are due and how much is owed. To schedule and pay your federal and state tax liability in QuickBooks, you must first set up your payment schedule.

Step 3: Check if the liabilities are updated

Adjusting employer contribution parameters, such as retirement plans or health benefits, should be carefully assessed to align with company policies and employee benefits. QuickBooks Online provides user-friendly options for these adjustments, allowing businesses to customize their payroll settings efficiently. It is critical to consider the implications of these changes, including potential impacts on employee paychecks, tax filings, and financial reporting. Following the setup adjustments, it is crucial to review and modify individual employee payroll records within QuickBooks Online, ensuring that the recalculated liabilities and taxes accurately reflect the changes made to the overall payroll setup. Following the setup adjustments, it is crucial to review and modify individual employee payroll records within QuickBooks, ensuring that the recalculated liabilities and taxes accurately reflect the changes made to the overall payroll setup. This involves carefully updating each employee’s hours, wage rates, and any other relevant information in their respective payroll profiles.

Sign up for a double entry system of accounting new QuickBooks Desktop Payroll subscription or reactivate an old account. If the adjustment will impact or change the data on your quarterly return, you might consider doing a quarter-to-date adjustment instead of a year-to-date adjustment. With Labor Day in the rearview mirror, it’s time to take proactive steps that may help lower your small business’s taxes for this year and next. Before you can manually run payroll in QuickBooks Desktop, you need to enable payroll inside your QuickBooks settings.

Setting up payroll liabilities in QuickBooks Desktop involves configuring tax categories, defining payment schedules, and establishing employee contribution parameters to ensure accurate tracking and reporting of the company’s payroll obligations. Subsequently, it is essential to navigate to the payroll setup within QuickBooks and implement the required changes, which may involve modifying tax categories, updating withholding rates, or adjusting employer contribution parameters. Once the discrepancies are reconciled, the adjusted payroll liabilities and tax amounts can be accurately entered into QuickBooks Online, ensuring that the financial records reflect the updated information.

Step 2: Adjust your payroll liabilities

Learn how to use a liability adjustment to correct employees’ year-to-date (YTD) or quarter-to-date (QTD) payroll info in QuickBooks Desktop Payroll. Now that we’ve corrected your payroll records, I suggest you get in touch with the state agency. One of their specialists will guide you on how to properly handle the situation and make sure your state tax is in order. Adjusting payroll liabilities in QuickBooks Online involves similar steps to the small business financial solutions and wave desktop version, with the added convenience of cloud-based accessibility and collaborative functionality for streamlining the adjustment process. If it’s overpaid, check out Resolve a payroll tax overpayment to learn how to handle them.

Similarly, if a new tax law is enacted, it may lead to adjustments in tax calculations and withholdings. In this comprehensive guide, we will explore how to adjust payroll liabilities in QuickBooks, QuickBooks Online, and QuickBooks Desktop. From identifying the need for adjustment to making necessary changes in payroll setup and reconciling liabilities, we will cover the essential what is materiality in accounting information steps and best practices for each scenario. You can create a new payroll item or edit your addition, deduction or company contribution items to track expenses by job. Most common pay items and tax types are set up automatically during the initial payroll setup. Annual limits such as the Social Security tax wage limit update automatically at the start of each year.

After making these individual adjustments, it’s essential to reconcile the payroll records with the amounts owed to avoid any discrepancies. The initial step in adjusting payroll liabilities in QuickBooks Online is to identify the specific reasons or events that necessitate the adjustment, such as corrections in tax calculations or changes in employee wage withholdings. Upon completion, the revised liabilities are accurately entered into QuickBooks, with careful attention to detail to maintain accurate financial reporting and compliance with tax regulations. The initial step in adjusting payroll liabilities in QuickBooks is to identify the specific reasons or events that necessitate the adjustment, such as corrections in tax calculations or changes in employee wage withholdings. Reconciling payroll liabilities in QuickBooks involves comparing the recorded amounts with the actual liabilities, identifying any discrepancies, and adjusting the entries to ensure accurate alignment with the company’s financial reports and regulatory requirements.