Seniors, Gen X or Millennials Which Really Got They Terrible Financially?

Content

If your discount is due to have an economic downturn in the next while, that may certainly wreck the job candidates of numerous newly finished members of Gen Z beginning to come across operate in 2026. Baby boomers kept 51.8% out of household wide range at the conclusion of 2023, research that they consistently hold big economic and you can governmental energy although they get older. Accompanying the newest monetary prosperity is actually a great migration from lovers in the towns to your suburbs.

The good news is, you’ll find loads out of cashback searching programs you can use of. Below are a few MySurvey and you can View Outpost for many who’re also searching for real cash perks. You will find lots from it is really good things you to definitely people only want to eliminate in some way.

Finest Gambling enterprises playing Kid Bloomers Position for real Currency – critical hyperlink

Their work integrated working together that have tv makers critical hyperlink in the Tokyo to deliver punctual information articles to own FashionOne. The fresh totally free revolves ability would be brought about if participants belongings the brand new Spread out symbols for the reels. When three or maybe more Scatters appear on the fresh reels up coming the new gamers becomes ten totally free revolves quickly. Child Bloomers is actually a slot machine that has five reels with each other that have 10 pay lines.

What is the Wealth Gap in the us 2021?

Most other assets owned by seniors are worth all in all, $13.89 trillion, while you are millennials individual $2.23 trillion worth of other possessions. The difference within the property value the corporate equities and you can mutual finance shares is also better between the two generational organizations; baby boomers very own equities and financing to a total worth of $17.79 trillion. Millennials, simultaneously, just very own $0.72 trillion inside equities and financing, and therefore seniors individual 96% much more inside the money and you may equities than millennials.

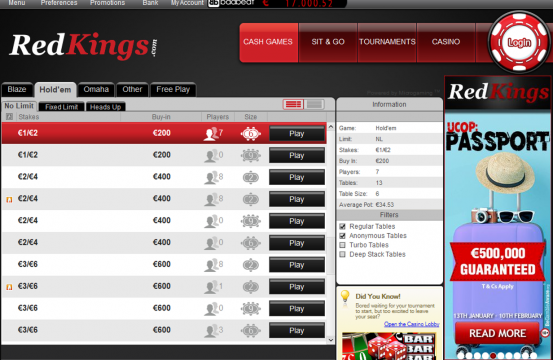

You do not need a slot Area Casino login to view the fresh trial element. You merely come across they and then click for the symbol indicating the new demonstration games feature. All the facts available in the actual money choice is and offered in the trial, therefore it is a option to routine. Experiment our free-to-gamble demonstration of Infant Bloomers on the web position no download and you will zero subscription necessary. Prices of fixed income bonds rise and you may fall-in response to changes in the rate paid because of the similar securities.

This won’t only give them much more current money and you will additional time in order to fat upwards the old age accounts. It will reduce the time that they can must count to their discounts to support them. As an alternative, he or she is are hit the toughest by sad series of economic incidents not too long ago. As they handle the fresh come out, they can only aspire to reduce debt and accumulate adequate money over the years to possess retirement. For the earliest away from millennials turning 40, economists are concerned that there isn’t enough time for most of them.

Equivalent Ports

The new average conversion process rates at the beginning of 2017 was only $313,100, or even the similar now of $402,000. If you are a property inside Michigan otherwise Kansas almost certainly won’t charge you a lot more than $150,one hundred thousand, would certainly be it really is lucky to get one thing for less than $one million inside San Jose or Atherton, California. During those times, they would features shelled out simply more an enthusiastic inflation-adjusted $52,one hundred thousand to own tuition, fees, area and you can board at the average five-year public college or university or $135,100000 to possess an exclusive college. Inside the genuine bucks, university fees can cost you rose which have an excellent compounded annual growth rate (CAGR) of over 7% a-year away from slide away from 1973 from slide away from 1990. You could potentially indeed intend to problem your self as the pupils so you can discover how far money you’ll save.

What exactly is a proven way middle-agers are ensuring the new life of their money? Millennials are stuck with disproportionately high rates out of student loan financial obligation and so are, an average of, marriage afterwards in life, and thus slowing down homeownership. They’re also facing high book will set you back one to put the guarantee away from home ownership out-of-reach, with regards to the Urban Institute’s declaration. To possess Jessica Yourdon, an excellent 36-year-old social network coordinator based in San Antonio, engaged and getting married past slide produced the brand new guarantee out of very first-day homeownership. But not, this really is scarcely the truth, the guy said, thus timeshares shouldn’t qualify comparable to carries, bonds otherwise a property. Along with, he told you, subscribers have a tendency to prevent playing with timeshares as they age, but you to definitely doesn’t stop fix charges away, and giving the secrets straight back tend to yield merely pennies to the dollar on the total price of possession.

Young Generations You are going to Get caught up so you can Boomers

Everything on the site has a work just to amuse and you will educate group. It’s the brand new people’ responsibility to check your local laws and regulations prior to to experience online. While you are Baby Bloomers is without question an on-line gambling establishment a real income slot that delivers players a bona-fide possibility to rating huge earnings, moreover it has a trial option. Choice which have demo money and talk about the fresh auto mechanics associated with the slot host to learn when it fits to the what you would like. The people study and you will wide range research to the silent age group, seniors, Age group X and you will millennials are based on the fresh Census as well as the Federal Set aside. At that time the study is actually carried out, zero investigation is readily available for Generation Z. The web well worth for every age bracket in the particular moments is computed using an algorithm (online well worth/population for each and every age bracket classification).

However, you to definitely departs 43% who aren’t — and an incredible number of middle-class and you will low-income People in the us, and also particular having high income, who you are going to explain to you the savings within this 2 decades out of making performs. As the 76 million seniors near the avoid of the doing work life, the world try hurtling to your a retirement overall economy. More all U.S. possessions — $41.8 trillion — come from a property, which is not too stunning considering simply how much possessions values has improved across the many years. Following been equities and common money ($33.8 trillion), sturdy merchandise or any other property ($33.step 3 trillion) and you may retirement benefits ($31.step 1 trillion).

What of several usually do not imagine is when considerably the new senior years-investment landscaping has evolved over the past few ages. The largest change is the shift of outlined-work for agreements, otherwise pensions, to help you discussed-sum preparations, such 401(k)s and IRAs. Employers began to remove otherwise frost pensions since the market volatility is actually jeopardizing pension-fund investment. Meanwhile, 401(k)s were introduced, providing some professionals; for example, they were mobile from job to some other. Nevertheless the move from secured lifestyle income in order to personal financing accounts shifted exposure and you will duty away from enterprises to experts — not just to save to possess senior years, but to invest those individuals discounts during the a renewable speed. They are both vulnerable to circumstantial issues and you will ordinary people misjudgment.