Greatest 5 Technical Evaluation Tools For Indian Stock Market 2023

Traders can use these lines’ crossover and different technical indicators to determine when to enter or exit a trade. To effectively handle your buying and selling positions, it is essential to contemplate the potential risks of overbought and oversold situations. Support and resistance levels are key concepts in technical evaluation autochartist brokers. Support represents a price level at which a stock tends to search out shopping for interest, stopping it from falling additional. Resistance is a degree the place selling curiosity usually arises, stopping the inventory from rising higher.

High Technical Evaluation Instruments For Buying And Selling – An Introduction Guide Kindle Edition

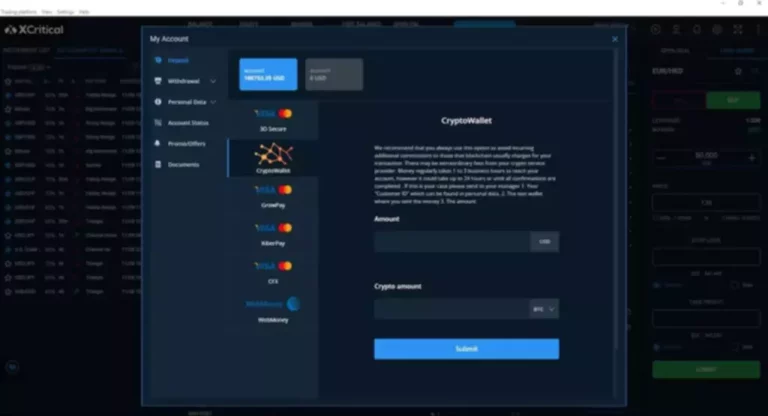

Our platform features a suite of technical analysis instruments which are simple to understand and use, serving to you make knowledgeable decisions and grow your buying and selling skills. The dealer workstation (TWS) of Interactive Broke has a charting system that is highly customizable, with many indicators, and live-flowing information. By having over a hundred and twenty indicants and over 30 years of data, TWS is acknowledged as a very strong tool for technical analysis. There is a trial version that can be run concurrently with the complete version for the dealer to practice the trading scenarios.

Shifting Common Convergence Divergence (macd) Indicator

- Welles Wilder, it ranges from 0 to 100 and helps merchants identify overbought and oversold circumstances out there.

- The distribution of this doc in sure jurisdictions may be restricted by regulation, and individuals in whose possession this doc comes, should inform themselves about and observe any such restrictions.

- Cycle – Various securities, particularly spinoff devices (futures) tend to maneuver in cyclical patterns.

- Fidelity’s study centre focuses on the technical facet of trading; they provide movies, articles, infographics, Webinars, and recorded Webinars.

They help traders make informed selections, identify entry and exit points, and manage dangers successfully. The secret to successful swing buying and selling lies in a mix of things, including technical analysis, risk management, and discipline. Swing merchants goal to capture quick to medium-term worth actions inside a trend. Additionally, staying informed about market information and financial events may help swing merchants make knowledgeable decisions.

Key Technical Indicators In Trading

Traders can gain priceless insights into market trends and worth movements by understanding and using indicators similar to Bollinger Bands, RSI, and EMAs. Combining a quantity of indicators and constantly adapting your technique to the current market circumstances will improve your trading performance. Stay knowledgeable, practice risk administration, and all the time strive to refine your approach to remain ahead in India’s dynamic world of intraday buying and selling. Volume evaluation includes studying a stock’s trading quantity to understand the strength of a price movement.

Adx ( Common Directional Index)

There can also be the power to link analytics platforms to the IBKR account and the Investors Marketplace lists merchants. Thinkorbswim by TD Ameritrade is an utility that is designed for options traders. It permits them to put their most well-liked instruments into it to shape the buying and selling setting as they need. Thinkorswim was developed for option traders and many of the instruments helpful to equities merchants embrace technical evaluation tools, drawing instruments, and charting merchandise. Traders apply Fibonacci retracement to pinpoint where to buy or sell, gauge the power of a trend, and resolve on entry or exit factors. This tool is very useful in the Indian stock market for recognising key value ranges and guiding buying and selling decisions, similar to setting stop-loss orders to manage threat.

Understanding Gaps In Stock Charts: Gap Up, Gap Down, And Trading Methods

Common candlestick patterns include doji, hammer, shooting star candlestick patterns, and engulfing patterns. Each pattern has particular implications for future worth actions.For instance, a hammer sample on the bottom of a downtrend indicators a possible bullish reversal. Technical analysis is a robust software on the earth of economic trading and funding. It is the artwork and science of analyzing historic price charts and trading volumes to predict future worth actions in monetary markets. By analysing patterns, tendencies, and numerous indicators, technical analysts aim to make informed decisions about shopping for or selling assets like shares, currencies, commodities, and cryptocurrencies.

When the development reverses, the dots switch to above the worth, signalling merchants to exit lengthy positions or contemplate quick positions. Individuals can develop their analysis instruments with Thinkorswim utilized by the merchants. Think permits you to additionally use thinkScript, a scripting language that comes with the applying.

High 5 Proven Strategies For A Multi-timeframe Analysis

It’s additionally useful for recognizing potential reversals in value tendencies. Investments in securities market are topic to market risks, read all the associated paperwork rigorously earlier than investing. The securities are quoted as an example and never as a recommendation. FinLearn Academy supplies vastly researched and in-depth buying and selling and investing programs, in partnership with NSE, throughout all asset classes- Stocks, Futures, Options, Commodities & Currencies.

When the MACD line crosses above the signal line, it generates a buy sign, and when it crosses below, it produces a promote signal.The MACD histogram indicates the strength of the pattern. This indicator is widely used for its capacity to disclose modifications in the power, path, momentum, and duration of a development in a stock’s worth. Bollinger bands are another in style used technical evaluation software. It consists of a center band which is an SMA and two outer bands that represent normal deviations above and below the center band.

If you’d wish to grasp the required calculations, just do some extra studying and see if this indicator works for you. For these keen on enhancing their buying and selling acumen and boosting their market data, continue studying to uncover the premier technical evaluation instruments for Indian stocks. Traders use different technical indicators just like the Relative Strength Index (RSI), transferring averages, and Bollinger Bands to grasp worth adjustments better.

MACD (Moving Average Convergence Divergence) is certainly a priceless indicator for swing trading. It helps merchants determine trends, momentum shifts, and potential entry and exit factors. By evaluating two moving averages, MACD provides insights into the power and path of a safety’s development. However, like all indicators, it’s essential to make use of MACD along side other instruments and analyse market situations to make well-informed swing buying and selling selections.

Continuous studying, apply, and adaptability are important for mastering the artwork of swing buying and selling. These patterns type on worth charts and point out potential future value actions. Common chart patterns embrace head and shoulders, double tops and bottoms, triangles, and flags.Each pattern has specific characteristics and implications for value path. For occasion, a head and shoulders sample sometimes indicators a reversal in an uptrend, whereas a double bottom suggests a bullish reversal. These patterns assist traders anticipate market actions and make knowledgeable decisions primarily based on historic value actions. This article explores the various kinds of technical evaluation, their options, and their applications.

By monitoring the RSI, merchants could make extra informed decisions about when to enter or exit a trade. Technical evaluation instruments are priceless sources that may assist merchants in making informed selections within the inventory market. By analysing worth motion and market developments, merchants can acquire insights into the behaviour of shares and make predictions about future movements. An instance of technical evaluation is using a shifting common to determine developments in a share’s price.

Read more about https://www.xcritical.in/ here.